Conducted for the past 25 years, the National Association of Home Builders Housing Market Index gauges builders’ perception of the market for newly built, single-family homes. Results are scored on a scale where any number above 50 indicates more builders view conditions as good than poor. The survey asks builders for their view of current sales, sales expectations for the next six months, and buyer traffic. This month’s results showed no change from the month before, holding steady at 54. Rick Judson, NAHB’s chairman, said given the current interest rate and pricing environment, consumers continue to show interest in purchasing new homes. But, according to Judson, Congress has failed to make critical decisions on budget, tax, and spending issues, which has eroded consumer confidence and caused some potential buyers to hold back. More here.

Tag Archive for confidence

New Home Market Strong Among Buyers Over 55

A recent survey of builders shows increasing confidence in the market for new homes among buyers over the age of 55. According to the National Association of Home Builders’ latest 55+ Housing Market Index, significant gains were made in the third quarter as compared to the third quarter of last year. The index found confidence in the market for single-family homes, rose 14 points to its highest third-quarter number since the survey began in 2008. It also represents the eighth straight quarter of year-over-year increases. Robert Karen, chairman of NAHB’s 50+ Housing Council, said there has been steady improvement in the 55+ housing sector as buyers are attracted to new homes and communities that offer the lifestyle they desire. All components of the survey gauging interest in single-family homes experienced double-digit increases over last year. The survey asks builders to rate current sales, expected sales, and traffic of prospective buyers on a scale where any number over 50 indicates more builders view market conditions as good than poor. More here.

Americans’ Confidence Rebounds Following Fiscal Deal

Recently shaken by the government shutdown and debt ceiling negotiations, Americans’ confidence in the economy has already begun to rebound after lawmakers reached a deal to avoid defaulting on the nation’s debt. According to Gallup’s most recent Economic Confidence Index, Americans responded positively to news that the shutdown had ended, leading to the first improvement in economic confidence since September 15. But despite the gains, 69 percent of Americans still say the economy is getting worse while just 27 percent say it’s getting better. And the index, though improved, is still significantly lower than it was in May and early June when it peaked for the year. Overall, Americans’ perception of where the economy is headed was damaged by nearly a month’s worth of economic uncertainty but appears to have rebounded quickly. More here.

Builder Confidence Slips Slightly In October

Builders were slightly less optimistic about the market for newly built, single-family homes in October, according to the National Association of Builders’ Housing Market Index. The Index measures builder confidence on a scale where any number above 50 indicates more builders view conditions as good than poor. In October, the Index fell two points to 55. According to NAHB chief economist, David Crowe, the government shutdown contributed to the slip in confidence. Crowe said the shutdown and uncertainty regarding the nation’s debt limit caused builders and consumers to take pause. Still, the component measuring sales expectations for the next six months posted a reading of 62 and current conditions were scored at 58. Rick Judson, NAHB’s chairman, said builder optimism remains above 50 and there are still signs of pent-up demand in many markets across the country. Judson believes the drop in confidence is due to temporary uncertainty and challenges with regard to cost and availability of labor. More here.

Americans Cautious But Still Eager To Buy

The number of Americans who say they’d buy, rather than rent, if they were going to move increased during the month of September, according to Fannie Mae’s September 2013 National Housing Survey. The survey, which polls 1,000 Americans every month via telephone to assess their attitudes toward owning, renting, prices, mortgage rates, the economy, household finances, and overall consumer confidence, found 69 percent of respondents say they’d prefer to buy a home over renting. The number who said they felt it was a good time to buy a house also rose, increasing to 72 percent. Still, the level of optimism about the overall economy has begun to plateau after recent improvements. According to Doug Duncan, senior vice president and chief economist at Fannie Mae, September’s results reflect Americans’ uncertainty about economic policy leading up to the government shutdown and debt ceiling debate. The survey shows that the improvements in consumer housing attitudes witnessed in recent months softened ahead of the government shutdown, Duncan said. How these fiscal policy issues are addressed could impact Americans’ attitudes and influence the economic and housing recovery in October and beyond. More here.

Economic Confidence Improves Despite Uncertainty

After nearly reaching positive territory in early June, Americans’ confidence in the economy has been on a downward trajectory, according to Gallup’s Economic Confidence Index. In recent weeks, economic confidence has been negatively impacted by the crisis in Syria, stagnant job growth, upcoming negotiations over the federal debt limit, and uncertainty over the Federal Reserve’s bond-purchasing program. Still, the most recent reading found a small improvement from previous weeks. According to the index, 40 percent of Americans now say the economy is getting better rather than worse, with 19 percent rating the economy as excellent or good and 36 percent saying it is poor. Gallup notes that Americans have generally been more confident in the economy this year, though they are still more negative than positive in their assessment of current conditions and the economic direction.

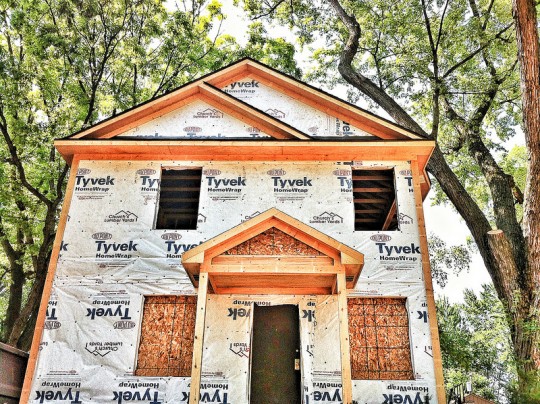

Builders Confident In Market For New Homes

When it comes to gauging the health of the market for newly built homes, professional builders offer an unique perspective. Because of this, the National Association of Home Builders conducts a monthly survey to determine the level of confidence home builders have in the market. The survey, conducted for the past 25 years, scores builders’ confidence so that any number above 50 indicates more builders view conditions as good than poor. In September, the Index was unchanged from the previous month at 58. September’s reading follows four consecutive months of gains. Rick Judson, NAHB’s chairman, said confidence is holding at the highest level in nearly eight years but buyers are beginning to express more hesitancy due to recent increases in mortgage rates. Despite the increases, however, interest rates are still quite low based on historical norms, Judson said. More here.